Can I Use PayPal Credit to Send Money to Myself?

PayPal Credit, a financial tool that extends payment options, offers users the flexibility they crave for online transactions. However, an intriguing question often arises: “Can I use PayPal Credit to send money to myself?” In this comprehensive article, we unravel the mysteries surrounding this query. We’ll delve into the possibilities, cautionary aspects, and alternative methods, ensuring you navigate the world of PayPal Credit with confidence, making informed financial decisions that align with your goals.

Key Takeaways

- PayPal Credit Self-Sending Limitations:

- Generally, PayPal Credit does not allow users to send money to themselves, aligning with policies to prevent the misuse of credit lines and to discourage practices like accessing cash advances.

- Risks and Costs of Self-Sending:

- Engaging in self-transfers, even through indirect means, might introduce additional costs, such as transaction fees and potential interest charges, particularly if payments are not made punctually.

- Alternative Methods Exist with Caveats:

- While direct self-sending isn’t typically allowed, some alternative methods, like using a trusted friend for transfers or utilizing the “eBay trick” by purchasing electronic gift cards, can be employed with associated costs and risks.

- Understanding Costs and Usage of PayPal Credit:

- Responsible use of PayPal Credit entails an understanding of the various fees, interest rates, and penalties associated with its use to ensure sound financial management and avoid unintended financial pitfalls.

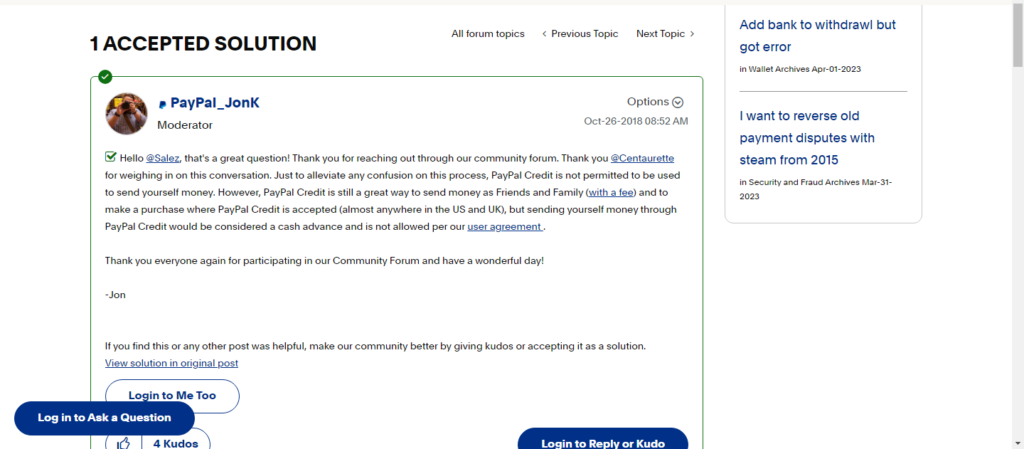

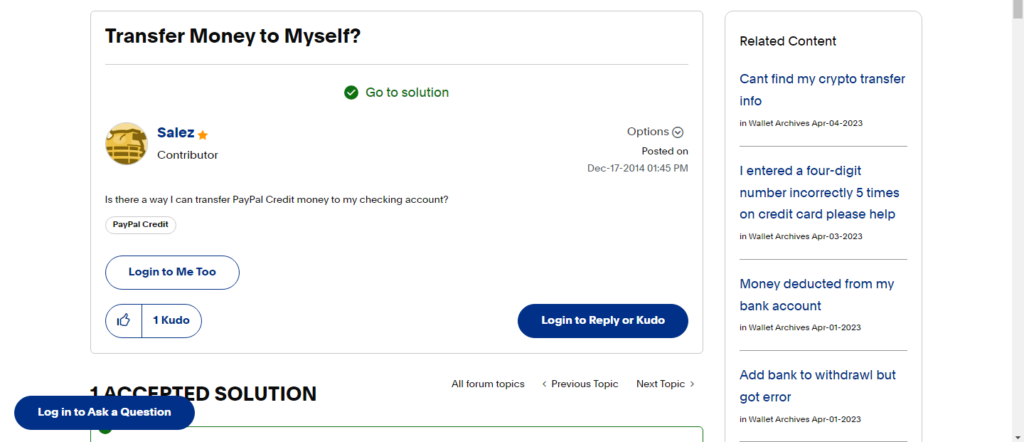

Can You Send Money to Yourself with PayPal Credit?

The notion of utilizing PayPal Credit to transfer funds to oneself is a tempting prospect. However, the answer, in most cases, is a resounding “no.” PayPal Credit typically does not accommodate self-transfers. The exceptions to this rule primarily apply to users in the United States. In the UK, the capability to transfer PayPal Credit to oneself remains elusive. Understanding these limitations is pivotal to avoiding pitfalls and unexpected charges while using this financial resource. But why does PayPal Credit prohibit self-sending? Let’s delve into the reasons in the following section.

The Cautionary Aspects of Sending Money to Yourself

While the desire to send money to oneself using PayPal Credit may seem harmless, it’s essential to comprehend the underlying reasons behind its restriction. First and foremost, this prohibition aligns with PayPal’s policies to prevent the misuse of credit lines for unapproved purposes. Self-transfers could potentially enable individuals to access cash advances, a practice discouraged by PayPal’s user agreement.

Moreover, engaging in self-transfers may introduce additional costs and financial risks. PayPal Credit often imposes fees for such transactions, eroding the value of the transfer. Failing to make payments on time can lead to the accumulation of interest charges, making it a costly endeavor.

Understanding these cautionary aspects highlights the importance of using PayPal Credit judiciously and in line with its intended purpose, helping users make informed decisions and avoid financial pitfalls. While self-sending remains limited, there are alternative methods to achieve similar financial goals, which we’ll explore in subsequent sections.

How to Send Money to Yourself with PayPal Credit

Sending money to oneself using PayPal Credit, while restricted, is technically feasible with the help of a trusted friend or relative in the United States. Here’s a step-by-step guide on how to navigate this process:

1. Log into Your PayPal Account: Begin by accessing your PayPal account. Ensure you’re logged in to the correct account that holds your PayPal Credit.

2. Choose “Send Money”: Once you’re logged in, select the “Send Money” option. This initiates the transfer process.

3. Enter the Recipient’s Email Address: In the recipient field, enter the email address of the trusted friend or relative who will assist you in the transfer.

4. Specify the Transfer Amount: Input the amount you intend to send to yourself. Double-check for accuracy.

5. Set the Payment Method to PayPal Credit: This step is crucial. Choose PayPal Credit as the payment method, as it is the primary focus of this transaction.

6. Click “Send”: With all details entered correctly, click the “Send” button to initiate the transfer.

It’s important to note that there will be a small transaction fee associated with this method. While it might incur an extra cost, the convenience of accessing your PayPal Credit can be worth it for certain users. After the recipient receives the funds in their PayPal account, they can, in turn, send the money back to you. This essentially allows you to achieve your goal while navigating PayPal Credit’s limitations.

Alternative Methods to Obtain Funds from PayPal Credit

In situations where the direct transfer of PayPal Credit funds to oneself is restricted, there exist alternative methods to access your credit line. One such method is known as the “eBay trick.” This approach involves purchasing a PayPal electronic gift card on eBay, which is usually delivered to your email within a relatively short time frame, typically 10-20 minutes. Once you have the gift card, you can use it for the intended purpose, effectively achieving your financial goal.

Another approach involves creating your own eBay listing and making a purchase from your own listing. While this strategy can help bypass the restrictions on self-transfers, it often comes at a cost. For example, if you use a credit card for the transaction, it may be considered a cash advance, incurring additional fees.

Additionally, PayPal offers an invoice feature for sellers, enabling the generation of invoices for fictitious purchases. However, for new sellers, received funds may be held for 21 days. It’s essential to link your eBay and PayPal accounts to different bank accounts to navigate this method effectively.

Understanding PayPal Credit

PayPal Credit serves as a financial resource that extends payment periods for specific purchases based on users’ creditworthiness. Managed by Synchrony Bank (formerly GE Capital), PayPal Credit collaborates with online retailers, allowing users to select “PayPal Credit” as a payment method during the checkout process on websites that accept PayPal payments.

When shopping online at participating merchants, users have the option to choose PayPal Credit if they have an account. If their credit limit allows, the purchase is typically approved. For purchases exceeding $99, users have up to 6 months to make payments without accruing interest. However, for purchases under $99, paying the balance in full is necessary to avoid interest charges.

Monthly, a minimum payment is due, which can be paid automatically or manually via a PayPal account.

PayPal Credit Charges and Considerations

Understanding the cost associated with PayPal Credit is pivotal for responsible use. The Annual Percentage Rate (APR) for both standard purchases and cash advances is 28.74%, subject to fluctuations based on the Prime Rate. The same APR applies to Cash Advances, including self-transfers. Interest isn’t charged on non-promotional transactions if the balance is paid in full by the due date.

Penalties are part of the equation as well. Late payments may result in charges of up to $41.00, while returned payments can incur fees of up to $30.00.

By grasping these charges and considerations, PayPal Credit users can make informed decisions, ensuring their financial management aligns with their goals and budget. Responsible usage, combined with an understanding of costs, can lead to a more positive experience with this financial tool.

Conclusion:

In conclusion, navigating the intricacies of using PayPal Credit for self-transfers can be both enticing and challenging. While limitations often prevent direct self-sending, alternative methods, such as the “eBay trick,” exist but come with associated costs and complexities. It is vital to grasp the reasons behind these limitations, primarily to prevent misuse and deter cash advances.

Understanding the fees, interest rates, and potential penalties associated with PayPal Credit is essential for responsible use. By being aware of these considerations, users can make informed financial decisions that align with their goals and budget.

Ultimately, responsible usage, combined with a grasp of costs and limitations, ensures a positive experience with PayPal Credit, allowing users to manage their financial needs effectively.

Frequently Asked Questions (FAQs)

Typically, PayPal Credit does not allow users to transfer funds directly to their bank account or to themselves to prevent misuse and unapproved practices like accessing cash advances.

Yes, utilizing PayPal Credit to send money usually involves transaction fees, and failure to repay the borrowed amount on time can result in interest accrual at an APR of 28.74% (subject to fluctuations).

PayPal Credit unequivocally stands as a viable financial conduit for online purchases, available with participating merchants, and boasts a notably generous payment structure. Purchases exceeding a threshold of $99 are eligible for an interest-free period extending up to six months, contingent upon the balance being assiduously settled within this designated timeframe. It is imperative to note that adherence to monthly minimum payments is not merely suggested but mandatorily required. Engaging with this financial tool demands a comprehensive understanding and strategic planning of repayment to navigate its utility effectively.”

While restricted, alternative methods such as using a trusted friend for transactions, purchasing PayPal electronic gift cards on eBay, or creating your own eBay listing are possible but come with their own sets of costs, risks, and complexities.